Russ Heddleston is the co-founder and CEO of DocSend. Previously, he was product manager at Facebook, where he arrived after taking over his startup Pursuit.com, and held positions at Dropbox, Greystripe and Trulia. Follow him here: @rheddleston and @docsend

More contributions from this contributor

- Pre-Seed Round Funding To Be Put To The Test: Is The VC Pandemic Stance Here To Stay?

- What to expect from fundraising in 2021

The way to a successful one Financing round can be long and arduous.

From your first meeting with a VC to the money in the bank, a seed round takes an average of 18.5 weeks. Within this timeframe you will beat out several investors and ideally arrange a series of meetings, either virtual or face-to-face.

You’re also busy building and constantly tweaking your narrative (and pitch deck) and managing each of these meetings and the necessary follow-up. Then, when things go well, negotiate term sheets and final closing details. Running a startup with the same intensity all the time.

When you have transparency about how investors interact with your pitch deck, you have an advantage.

So how do you prepare for this critical phase of business growth, mastering the challenges of a fundraiser, and not letting the process overwhelm the responsibility for running your business? While not every fundraiser is created equal, founders can draw on the experiences of others who have come down this route to ensure that their fundraiser is efficient, and most importantly, successful.

This can be done both qualitatively and quantitatively. Use your network to learn from both colleagues who recently went through the fundraising process and more seasoned experts who can impart useful wisdom and perspective. And quantitatively, there is a ton of data on the fundraising process that can remove the mystery and uncertainty for you as a founder. When you have very clear data on where VCs spend their time on pitch decks or in meetings, you can deliver a finely tuned pitch to the right investor.

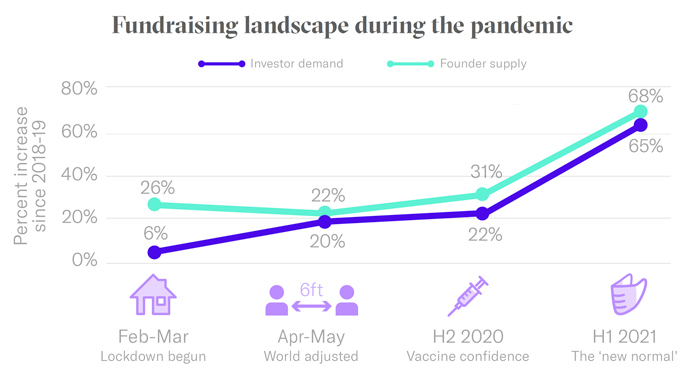

This year has seen growth in the fundraising landscape like we have never seen before. Deal dollar records have been broken continuously, and VC demand and startup supply have steadily increased since April 2020. While the tide has apparently turned in the founders’ favor, there are different investor expectations for each funding phase, from pre-seed to Series A and beyond.

Credit: DocSend’s weekly PDI metrics

As more and more founders introduce their startups, funding rounds are competitive, so you need to prepare accordingly. Below, I’m going to outline some key steps every founder will take during their fundraising journey, with proven and data-driven strategies to approach them.

The right pitch deck

A good pitch deck is key to opening the door to funds. It’s the first impression you make on a VC, and with they’re racing through the decks at record speed (2 minutes and 34 seconds per deck), yours has to count. It needs to clearly communicate purpose and value, and show that your business is a solid investment and that your idea is worth your money and time.

By analyzing the deck composition and comparing it to metrics, DocSend has found that startups that have successfully raised donations have similarities in their pitch decks. This can be broken down into different phases and will help you understand the order of your slides, which sections to include in more detail, which sections are getting the most attention, and more.