Cointelegraph is following the development of an entirely new blockchain from the beginnings to the mainnet and beyond through its Inside the Blockchain Developer’s Mind series. In earlier parts, Andrew Levine of the Koinos Group some of the challenges The team that the team has faced since identifying the main issues it wants to solve and outlines three of the “crises” that are holding back blockchain adoption: Upgradeability, Scalability and guide. This series focuses on the consensus algorithm: Part 1 is about proof of work, Part 2 is about Proof-of-Stake and Part 3 is about Proof-of-Burn.

This article is the second in my series on consensus algorithms in which I use my unique perspective to help the reader gain a deeper understanding of this often misunderstood concept. In the first article in the series, I examined the proof-of-work (the OG consensus algorithm) and in this article I will examine the proof-of-stake.

As I explained in the last article, from a game theory perspective, blockchains are a game where players compete to validate transactions by grouping them into blocks that correspond to the transaction blocks created by other players. Cryptography is used to hide the data that would allow these people to cheat and then a random process is used to distribute digital tokens to people who play by the rules and produce blocks similar to those of other people the blocks submitted. These blocks are then chained together to create an auditable record of all transactions that have ever occurred on the network.

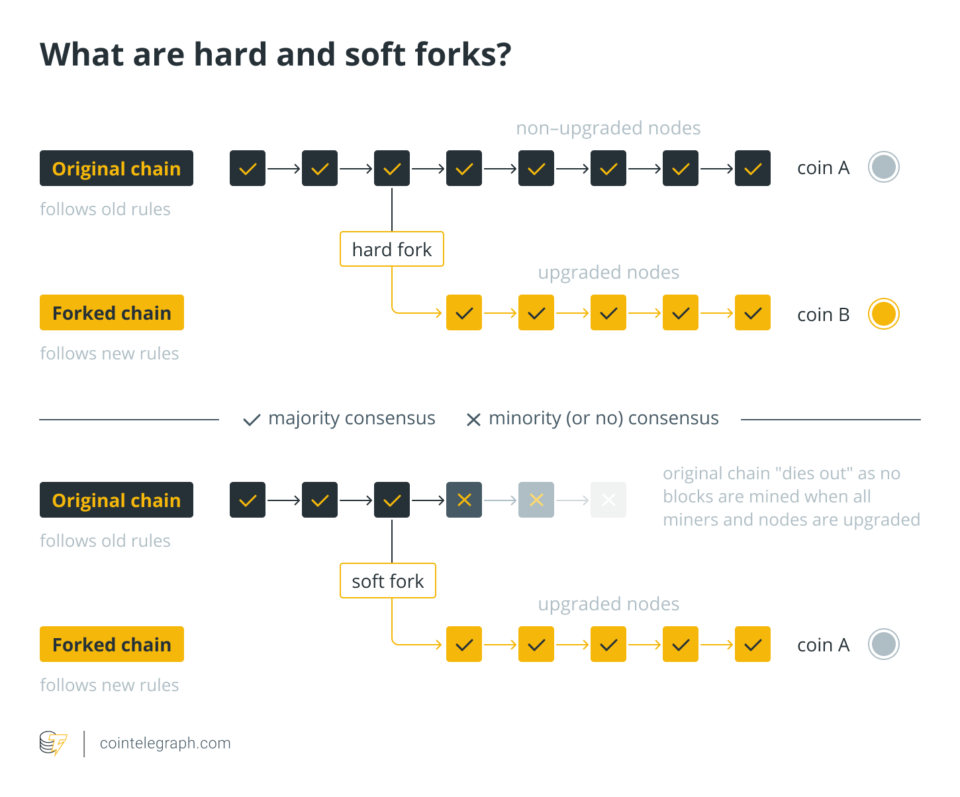

When people produce new blocks with different transactions we call this a “fork” because the chain is now branching in two different directions and what makes sure everyone updates their database to match each other is the way it penalizes if they don’t.

The real innovation in Bitcoin (BTC) was the creation of an elegant system of combining cryptography with economics to use electronic coins (now called “cryptocurrencies”) to incentivize solving problems that algorithms alone cannot solve. People have been forced to do pointless work to mine blocks, but security does not come from doing work, but from knowing that that work could not have been done without sacrificing capital. If this were not the case, there would be no economic component of the system.

The work is a verifiable proxy for sacrificed capital. Since the network has no way of “understanding” money outside of it, a system had to be implemented that converts the external incentive (fiat currency) into something the network can understand – hashes. The more hashes an account generates, the more capital it must have sacrificed and the more incentives there are to produce blocks on the right fork.

Since these people have already spent their money buying hardware and running it to produce blocks, their punishment is simple because they have already been punished! They’ve spent their money, so if they want to keep producing blocks in the wrong chain, that’s fine. They will not earn rewards and will not get their money back. You will have sacrificed that money for nothing. Your blocks will not be accepted by the network and you will not receive tokens.

This proof-of-work system ensures that someone who disobeys the rules (aka a malicious actor) sources and operates more hardware than everyone else combined (i.e., conduct a 51% attack). That’s the elegance behind proof-of-work. The system cannot work without sacrificing more and more capital. However, the proof-of-stake works in a fundamentally different way that has important game theory implications.

Related: Proof-of-stake vs. proof-of-work: differences explained

Proof of participation

Proof-of-stake (PoS) came first suggested in 2011 by Bitcointalk forum member QuantumMechanic as a cheaper (for the miner) alternative to proof of work:

“I wonder whether, as bitcoins become more widespread, there could be a transition from a proof-of-work-based system to a proof-of-stake. What I mean by Proof of Stake is that your “vote” on the accepted transaction history is weighted not according to the proportion of computer resources you bring into the network, but according to the number of bitcoins that you can prove with your private key . “

Rather than forcing block producers to sacrifice capital to acquire and operate hardware in order to be given the opportunity to earn block rewards, the proof-of-stake only requires token holders to sacrifice the liquidity of their capital to earn block rewards. People who already have a network’s token can earn even more from that token if they give up the right to transfer those tokens for some time.

This is an attractive proposition for people who are used to sacrificing money buying and running hardware in order to earn block rewards. Proof-of-work is great for bootstrapping a cryptocurrency, but once that stage is over, the owners of that valuable currency will have to take advantage of the fruits of their labor – that valuable currency – against an external currency (often the fiat currency they are supposed to be using compete) to buy capital goods and energy just to maintain their system.

Related: Proof-of-Stake vs. Proof-of-Work: Which is “fairer”?

The proof-of-stake is great for allowing these people to increase their profit margins while staying in control of the network. The problem is that it degrades network security because the malicious actor no longer has to sacrifice their money for and execute a large amount of hardware in order to launch an attack. The attacker only needs to purchase 51% of the platform’s base currency and use it to take control of the network.

To thwart this attack, PoS systems have to implement additional systems in order to “cut” the block rewards of a validator who has created irreversible blocks on a “losing” chain (“slashing conditions”). The idea is that if someone buys 49% of the token offering and uses that stake to produce blocks on a losing fork, they’ll lose their staked tokens on the main chain.

These are complex systems designed to “reclaim” block rewards from user accounts, adding to the computational burden of the network while raising legitimate ethical concerns (“Is it my money if it can be cut?”). They also only work if the attacker does not receive 51% of the token supply. This is particularly problematic in a world with centralized exchanges that have custody. This means that it is entirely possible for an exchange to control more than 51% of a given token offering without taking any risk, which makes the cost of an attack low. In fact, this has already happened in recent history on one of the most widely used blockchains in the world, once valued at nearly $ 2 billion: Steem.

An excellent story of this event can be found here. The important details for our purposes according to this report are that the funds held by three exchanges were successfully used to gain 51% control of a large blockchain. From the most charitable of all parties involved, it simply “cost” very little to take control of the chain for all of these companies because they acquired large shares at very low cost. In fact, centralized exchanges are literally paid to accumulate large stakes as their purpose is to act as centralized custodians of tokens.

Related: How the Steem saga exposes the dangers of staking pools

The implementation of these curtailment requirements is by no means trivial, which is why so many proof-of-stake projects like Solana were launched with centralized solutions and so many other projects (like ETH 2.0) took so long to implement PoS. The typical solution is to give a foundation a stake high enough that it alone has the power to determine who a malicious actor is and cut its rewards.

In summary, a proof-of-work is good for bootstrapping decentralization, but inefficient. Proof-of-stake is good for lowering the operating costs of a decentralized network compared to proof-of-work, but it further solidifies the miners, requires complex and ethically questionable cancellation terms, and does not prevent “replacement attacks”.

What I’ll discuss in my next article is the hypothetical question of whether there is a “best of two worlds” solution that delivers the decentralization and security of proof-of-work with the efficiency of proof-of-stake. So stay tuned!

The views, thoughts, and opinions expressed herein are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph.

Andrew Levine is CEO of Koinos Group, a team of industry veterans who are accelerating decentralization through accessible blockchain technology. Their basic product is Koinos, a royalty-free and infinitely expandable blockchain with universal language support.