The year 2021 is drawing to a close, and if there is any way to describe how the cryptocurrency industry has evolved over the past 12 months, it would be tremendous growth.

Major cryptocurrencies broke previous records, adoption grew, new sectors emerged, and novel blockchain use cases made major breakthroughs.

The latest edition of Market Insight recalls the events covered in previous editions as well as in-depth topics in the industry reports from Cointelegraph Research.

DeFi and Altcoins

Two of the top winners of 2021 were Solana (SOL) and Terra (LUNA). SOL gained 9,500% while LUNA gained 13,000%. Significant investments and the growth of the ecosystem catalyzed the immense gains for the two tokens. One could also argue that the two are considered potential “Ethereum killer“Contributed to their massive rallies.

In the decentralized finance (DeFi) scene, the two tokens are among the top 5 of the Total Value Locked (TVL). Solana ranks fifth at $ 11.45 billion, and LUNA recently acquired Binance Coin (BNB) for second place with $ 18.9 billion, according to Defi Llama. In addition, the emerging ecosystems of Solana and Terra deserve deeper insight, which is why they will be the subject of upcoming reports from Cointelegraph Research.

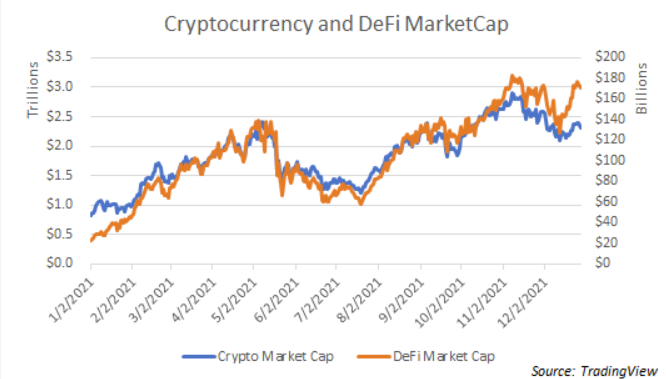

DeFi followed a growth path similar to that of the broader crypto market in 2021.

Competition for Ethereum has undoubtedly increased. The TVL share was 97% in January, but has now dropped to 62.54% per Defi Lama. The next phase of development for the sector is in consideration in 2022, especially since DeFi’s growth has been so strong that year that authorities have moved from rejecting the industry to grappling with ways to deal with it.

DeFi market capitalization remains a small fraction of the total market capitalization of cryptocurrencies, but has followed the same growth path. Some believe that integration with legacy banking could be one of the options the priorities for DeFi in 2022.

NFTs

Non-fungible tokens, or NFTs, made their breakthrough in 2021, despite having existed since 2014. The majority of sales were in the past 12 months, exceeding $ 14 billion in December. Digital art collections and digital collectibles dominate 91% of these sales volumes, which is one of the key figures in it report.

Sales in the first half of the year were driven mostly by individual artists who came into the space with their respective collections and some high profile sales, while more mainstream brands came on in the second half.

For example Coca-Cola A wearable bubble jacket skin is auctioned at Decentraland, and visa bought his first NFT. This involvement of these brands enabled the NFT market to be in full bloom. The report also revealed that the most profitable NFT collection in 2021 was “CryptoPunks”. A “CryptoPunk” NFT offers a better average return on investment compared to NFTs from other popular collections such as “CryptoKitties” and “Bored Ape Yacht Club”.

NFTs have also turned the gaming industry on its head and, through their blockchain properties, have become key to fully realizing the concept of the Metaverse. However, some critics doubt that the The parabolic surge in 2021 will take place in 2022, especially with more regulatory scrutiny.

Nonetheless, the amount of venture capital investment flowing into NFT companies this year is immeasurable. The NFT funding in 2021 has already been achieved $ 2.1 billion In the third quarter, however, according to PitchBook, almost 40% of VC’s business activities are only associated with a single company in Andreessen Horowitz. Therefore, as sales and interest in NFTs continue to grow, it can be difficult for companies with a thirst for high growth potential to resist NFTs.

regulation

2021 was progressive on the regulatory front for cryptocurrencies. The 117th United States Congress tabled 35 bills that focus on cryptocurrency regulation, blockchain policy, and central bank digital currencies. The Chairman of the Federal Reserve, Jerome Powell expressed his views about cryptocurrency as not a major threat to the stability of the US financial market. However, one likely discussion that could catch on over the next year is the regulation of stablecoins.

The President’s Working Group on Financial Markets has in a report that stablecoins could be an advantageous alternative payment option, but are “subject to appropriate supervision”. There are currently no regulations on stablecoins, even if their market cap has exceeded $ 162 billion at the time of this writing, but a bill proposed by Wyoming Senator Cynthia Lummis could be a step in that direction.

Lummis plans introduce a comprehensive law in 2022 This will provide regulatory clarity on stablecoins, guide regulators on asset classes and provide consumer protection. Regulation of cryptocurrencies will be a talking point in 2022 and also one that the Cointelegraph Research team will continue to investigate.

GameFi

It’s almost certain everyone in the world will agree that Axie Infinity revolutionized gaming. The play-to-earn model was a huge hit as it brought real income potential to playing video games. The data shows how play-to-earn decentralized applications (DApp) will be in relation to the second half of 2021. dominated connected, unique, active wallet addresses. And since September, gaming tokens like The Sandbox (SAND), Axie Infinity (AXS), Enjin (ENJ), Illuvium (ILV) and Ultra (UOS) have even beaten Bitcoin in profits since revealed in the last issue of this newsletter.

The gaming sector took over from DeFi, which saw most addresses connected for the first seven months of the year. The two DApp categories spawned a new sector, GameFi, which is seen as the next logical step in blockchain evolution. Crypto-based games already allow users to have control of their in-game assets through NFTs, but the elements of DeFi could take it to another level. The inclusion of DeFi would mean that features like staking would be available to users where they could earn interest on their tokens.

However, the sector is still in its early stages, but its appeal lies in its appeal to users who are not necessarily cryptocurrency holders. Attracting such users could further contribute to greater adoption of cryptocurrencies, which is likely to be the focus of GameFi in 2022.

adoption

With the developments in 2021, cryptocurrencies were able to win over a much wider audience compared to the previous year. In the second quarter alone, global adoption has increased 880% since 2020, according to Chainalysis data. And the above key events are likely to help make cryptocurrencies more mainstream. The aforementioned NFT venture capital activities only account for 7% of the $ 30 billion poured into crypto-related investments in 2021.

But despite the apparent growth, cryptocurrency ownership remains relatively low. TripleA estimates the global cryptocurrency ownership rate at an average of 3.9%. Ukraine, Russia, and Venezuela are the top countries where at least 10% of their population owns cryptocurrencies.

Despite increasing acceptance, the ownership of cryptocurrencies remains relatively low worldwide.

Despite increasing acceptance, the ownership of cryptocurrencies remains relatively low worldwide.

The low ownership rates imply considerable room for growth, which is why a CAGR of 60.8% from 2021 to 2026 for the cryptocurrency market can have some advantages. This year, the value of the cryptocurrency market has already risen from $ 364.5 billion last year to more than $ 2.5 trillion – an increase of 586%. And in the coming year, the new sectors in GameFi and possibly assets related to Web3 could potentially be new avenues for further growth.

The tokenization of certain securities could also be done on a much larger scale, and is even predicted to be the Norm until 2030. Additionally, the proliferation of cryptocurrencies for payments could be another area of untapped potential that will be explored further in another upcoming report.

Predicting which sectors will be ready for the same breakthrough NFTs had this year in 2022 would be difficult, if not impossible. However, reports that carefully study and delve into certain topics would provide a better way to understand the nuances of a particular sector.

Cointelegraph’s Market Insights Newsletter shares our knowledge of the fundamentals that drive the digital asset market. The newsletter covers the latest data on social media sentiment, on-chain metrics and derivatives.

We also review top industry news, including mergers and acquisitions, changes in the regulatory landscape, and blockchain integrations in companies. Sign up now to be the first to receive these insights. All previous editions of Market Insights are also available on Cointelegraph.com.