Analysts love making price predictions and it seems they get it wrong 9 times out of 10. For example, how many times have analysts said “we will never see Bitcoin at X price again” only to see it drop well below that level a few months later?

It doesn’t matter how experienced a person is or how connected they are in the industry. Bitcoins (Bitcoin) 55% volatility is something to be taken seriously, and the impact on altcoins tends to be stronger on capitulation-like moves.

I was undeniably wrong about how much crypto could fall from macro contagion.

I remain bullish on the whole space and I think this is the most important megatrend of our time.

I joined CT in 2018 and will be with you for years to come, bull or bear.

— Zhu Su (@zhusu) January 24, 2022

For those unfamiliar with the case, December 7th The capital of the three arrows by Zhu Su acquired $676.4 million worth of Ether (ETH) after its price plummeted 20% in 48 hours. Zhu even went so far as to say that he would continue to buy “any panic tip,” although he acknowledged that Ethereum’s fees are unsuitable for most users.

To understand if there is still an appetite for bearish bets and how pro traders are positioned, let’s take a look at Bitcoin’s futures and options market data.

Futures traders are not ready to short

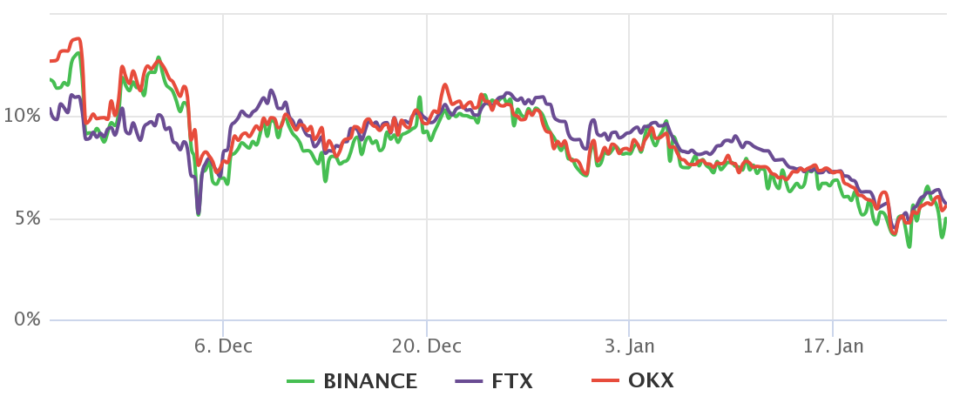

The basic indicator measures the difference between longer-dated futures contracts and current spot market levels. An annual premium of 5% to 15% is expected in healthy markets, and this price gap is being caused by sellers charging more money to hold settlement longer.

On the other hand, when this indicator fades or turns negative, a red alert arises, a scenario known as backwardation.

Bitcoin 3 Month Futures Base Price. Source: Laevitas.ch

Note that the indicator held the 5% level in 75 days despite the 52% price correction. Had pro traders actually taken bearish positions, the base rate would have fallen closer to zero or even into negative territory. Hence, the data shows a lack of appetite for short positions during this current corrective phase.

Options traders are still in the “fear” zone

To rule out externalities specific to the futures instrument, traders should also analyze the options markets. The 25% delta skew compares similar call (buy) and put (sell) options. The metric turns positive when fear prevails because the protective premium of put options is higher than that of similar-risk call options.

The opposite is true when greed prevails, causing the 25% Delta Skew indicator to turn negative.

Bitcoin 30-day options 25% delta skew. Source: Laevitas.ch

Bitcoin 30-day options 25% delta skew. Source: Laevitas.ch

The 25% skewness indicator turned into “fear” territory when it moved above 10% on January 21st. This 17% spike was last seen in early July 2021, and curiously Bitcoin was trading at $34,000 at the time.

This indicator could be interpreted as bearish considering that arbitrage desks and market makers overcharge for downside protection. Still, this metric is backward-looking and usually predicts market bottoms. For example, bitcoin price bottomed at $29,300 just two weeks after the skew indicator peaked at 17% on July 5.

The correlation with traditional markets is not that relevant

It is worth noting that bitcoin has been in a downtrend for the past 75 days, and this was before Federal Reserve tightening discourse on December 15th. Additionally, the increased correlation with traditional markets doesn’t explain why the S&P 500 index peaked on Jan. 4 while Bitcoin was already 33% below its all-time high of $69,000.

Considering the bears’ lack of appetite to short BTC below $40,000 and eventual capitulation from options traders, Bitcoin is showing little room for downside.

Additionally, bitcoin futures liquidation over the past week totaled $2.35 billion, significantly reducing buyer leverage. Of course, there is no guarantee that $32,930 was the ultimate bottom, but short sellers will likely wait for a rebound before entering bearish positions.

The views and opinions expressed here are solely those of author and do not necessarily reflect the views of Cointelegraph. Every investment and trading movement involves risk. You should do your own research when making a decision.