Bitcoin (BTC) continues to lose ground in December, suggesting traders may hedge profits before the end of the year. The lack of a Santa rally in the US stock markets suggests that risk-off sentiment is prevalent in several parts of the world due to the uncertainty about the spread of the COVID-19 variant of Omicron.

Even after the sharp drop in Bitcoin prices, demand from institutional investors remains subdued, and data shows that the largest institutional Bitcoin product, the Grayscale Bitcoin Trust (GBTC), Trade at a discount of more than 20%.

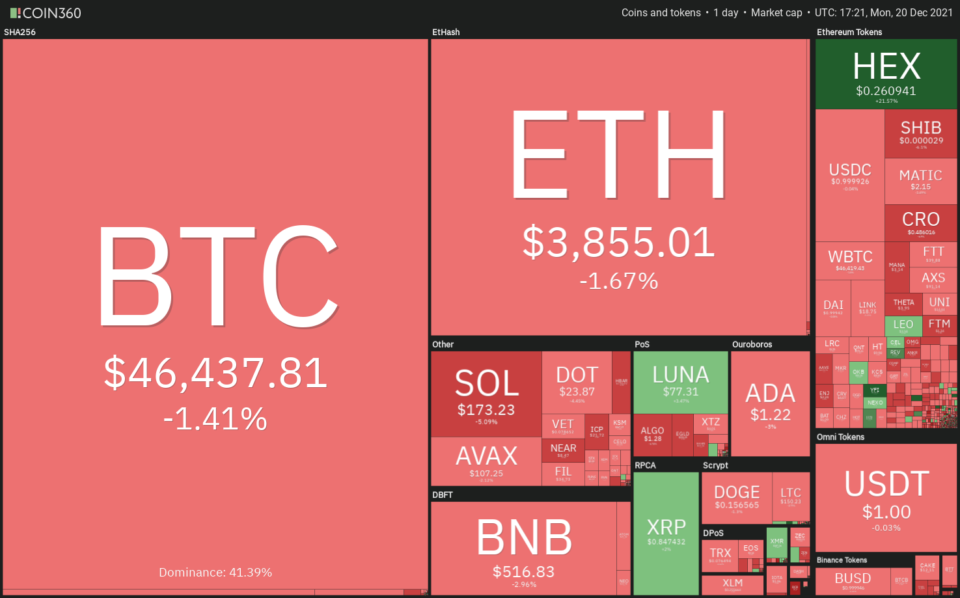

Daily performance of the cryptocurrency market. Source: Coin360

The experienced dealer Peter Brandt said: “Large-scale panic surrenders usually signal a bottom in Bitcoin and that has not happened during the current decline from the all-time high. This could be an indication that the “real” surrender is yet to come.

Could Bitcoin and most of the big altcoins continue their downward trend for the next few days, or will a Christmas rally come to the rescue? Let’s check out the top 10 cryptocurrency charts to find out.

BTC / USDT

The bulls have been defending the 200-day simple moving average ($ 47,130) for the past few days but have not been able to push the price above the 20-day exponential moving average ($ 49,622). This shows a lack of demand at higher levels.

BTC / USDT daily chart. Source: TradingView

BTC / USDT daily chart. Source: TradingView

The bears dragged the price below the 200-day SMA on December 20th, and if the price stays below this crucial level, sales could pick up pace. The BTC / USDT pair is in danger of hitting the strong support zone at $ 42,000 to $ 39,600. The bulls are likely to be aggressive in defending this zone, but the rebound could be challenging in the 200-day SMA.

This negative view could become invalid if the price rises from current levels and rises above the 20-day EMA. Such a move suggests that the break below the 200-day SMA may have been a bear trap. The pair could then climb to $ 52,000 and attempt a rally to $ 60,000 later.

ETH / USDT

Ether (ETH) has been trading on a descending channel for the past few days. The rebound from the channel’s support line on December 13th failed to rise above the 20-day EMA ($ 4,058), suggesting that bears are selling on rallies.

ETH / USDT daily chart. Source: TradingView

ETH / USDT daily chart. Source: TradingView

The falling 20-day EMA and Relative Strength Index (RSI) below 43 suggest that the path of least resistance is on the downside. The ETH / USDT pair could slide to $ 3,643.73 and then to the support line of the channel.

A strong rebound from the support line could add a few days to the channel. The bulls will then make one more attempt to push the price down the channel. If they are successful, it suggests that selling pressures may ease.

Alternatively, if price falls below the channel, the bears could challenge the 200-day SMA ($ 3,288). A break and close below this level could intensify selling.

BNB / USDT

Buyers have successfully defended the 100-day SMA (509) for the past few days, but they have not been able to push Binance Coin (BNB) above the 20-day EMA ($ 552). This suggests that demand is drying up at higher levels.

BNB / USDT daily chart. Source: TradingView

BNB / USDT daily chart. Source: TradingView

The falling 20-day EMA and the negative RSI suggest that the bears have the upper hand. If the price breaks through and below the 100-day SMA, the BNB / USDT pair could fall to the 200-day SMA ($ 436).

Contrary to this assumption, if the price rises from current levels and above the 20-day EMA, this suggests that the bulls have absorbed the supply. This could trigger a rebound to $ 617 and alongside stiff overhead resistance at $ 669.30.

SOL / USDT

Solana (SOL) moved down from the 20-day EMA ($ 183) on December 19, suggesting the bears are vigorously defending that level. If the price falls below $ 167.88 and holds, a retest of $ 148.04 is possible.

SOL / USDT daily chart. Source: TradingView

SOL / USDT daily chart. Source: TradingView

This is important support to look out for as a break below it could lower the SOL / USDT pair to the 200-day SMA (USD 120). The falling 20-day EMA and RSI below 43 suggest the bears are in control.

This negative view will be invalidated if the price rises from current levels and breaks above the 20-day EMA. Such a move suggests that selling pressures may ease. The pair could then attempt a rally to $ 200 and later to $ 240.

ADA / USDT

Cardano (THERE IS) has bounced off strong support at $ 1.18 repeatedly in the past few days, but the bulls have been unable to push the price above the 20-day EMA ($ 1.35). This indicates a lack of demand at higher levels.

ADA / USDT daily chart. Source: TradingView

ADA / USDT daily chart. Source: TradingView

The bears will now attempt to bring the price below $ 1.18 and hold it. If they do, the ADA / USDT pair could fall to the critical support at $ 1. The bulls will likely defend this level aggressively.

The first sign of strength will be a breakout and close above the 20-day EMA. Such a movement indicates that demand exceeds supply. The pair could rise to $ 1.47 first, then attempt a rally to overhead resistance at $ 1.87.

XRP / USDT

XRP has been trading between $ 0.75 and $ 0.85 in the past few days. The bulls pushed the price above $ 0.85 today, but the long wick on the candle suggests that bears will continue to sell in rallies.

XRP / USDT daily chart. Source: TradingView

XRP / USDT daily chart. Source: TradingView

The RSI has bounced back sharply from oversold levels, suggesting that bearish momentum may be losing strength. This could keep the XRP / USDT pair in the range for a few more days.

A breakout and a close above $ 0.85 suggest that the bulls have overwhelmed the bears. That could push the price down to the psychological mark of $ 1. Alternatively, a break and close below $ 0.75 could open the doors for a possible decline to $ 0.60.

MOON / USDT

Terra’s LUNA token hit a new all-time high today, but the long wick on the daily candle suggests that short-term traders may see higher profits.

LUNA / USDT daily chart. Source: TradingView

LUNA / USDT daily chart. Source: TradingView

If the price stays below USD 78.29, the bears will attempt to pull the LUNA / USDT pair to the 20-day EMA (USD 64). This is an important support to watch as a strong rebound suggests sentiment remains positive and traders buy on collapses.

The bulls will then try again to push the price above the overhead zone from $ 78.29 to $ 81.87. If they do, the pair could begin rallying toward the psychological level at $ 100.

Conversely, if bears pull price below the 20-day EMA, it suggests that traders are abandoning their positions. That could drop the pair to $ 50.

Related: 0.01% of Bitcoin Holders Control 27% of All Coins in Circulation: Study

AVAX / USDT

Avalanche (AVAX) bounced off strong support at USD 75.50 on December 14th and broke the downtrend line on December 15th. This indicated that the bulls are trying to resume the uptrend.

AVAX / USDT daily chart. Source: TradingView

AVAX / USDT daily chart. Source: TradingView

However, the upside moved from the 61.8% Fibonacci retracement level at $ 119.69, suggesting that bears are selling on rallies. The AVAX / USDT pair has hit critical support at the 20-day EMA ($ 99).

If the price recovers from current levels, buyers will try again to continue the upward move. A break and close above $ 119.69 could pave the way for a rally to $ 131.70 and later to the all-time high of $ 147.

Conversely, the pair could drift to the strong support at $ 75.50 if the price breaks below the 20-day EMA and holds.

DOT / USDT

Speckle (POINT) has traded below the 200-day SMA ($ 28.82) for the past few days. This suggests that bears are in command. The sellers are currently trying to bring the price below the strong support zone of $ 25 to $ 22.66.

DOT / USDT daily chart. Source: TradingView

DOT / USDT daily chart. Source: TradingView

If they do, the DOT / USDT pair could extend its downtrend towards the next support at $ 16.81. The longer the price stays below the 200-day SMA, the greater the likelihood that the downtrend will continue.

Contrary to this assumption, the bulls will make another attempt to push the pair above the 200-day SMA if the price rebounds from the current zone. If they succeed, it indicates that the bears are losing their grip. The pair could then move higher towards $ 39.35.

DOGE / USDT

Dogecoin (DOGE) rebounded from strong support at $ 0.15 on December 14 and rose above the 20-day EMA ($ 0.18), but the long wick on the candle shows traders were selling at higher levels.

DOGE / USDT daily chart. Source: TradingView

DOGE / USDT daily chart. Source: TradingView

The bears pulled the price back below the 20-day EMA on December 15. This may have trapped the aggressive bulls, who then may have been forced to liquidate their position. This pulled the price towards the strong support at $ 0.15.

A break and a close below this level could pull the price to the December 4th low of $ 0.13. If that support breaks, the DOGE / USDT pair could fall to the psychological level of $ 0.10. Conversely, if price bounces off current levels, the bulls will try again to break the overhead hurdle at the 20-day EMA and $ 0.19.

The views and opinions expressed are those of the author only and do not necessarily reflect the views of Cointelegraph. Every investment and trading movement involves risks. You should do your own research when making a decision.

Market data is provided by HitBTC Exchange.