Bitcoin (BTC) tries to break through the psychologically critical level of US $ 50,000 and end the year on a strong note. the Bitcoin moving up has caused the Crypto Fear & Greed Index’s value to rebound from 27 to 45 in one day, suggesting an improvement in sentiment.

BlockFi co-founder Flori Marquez said in a recent interview that new talent, regulatory clarity, and higher crypto prices could lead to a sense of FOMO. Promote crypto adoption in 2022. Marquez added that “the majority of Blockfi’s customers – when they receive a BTC reward, they are not selling it for cash”.

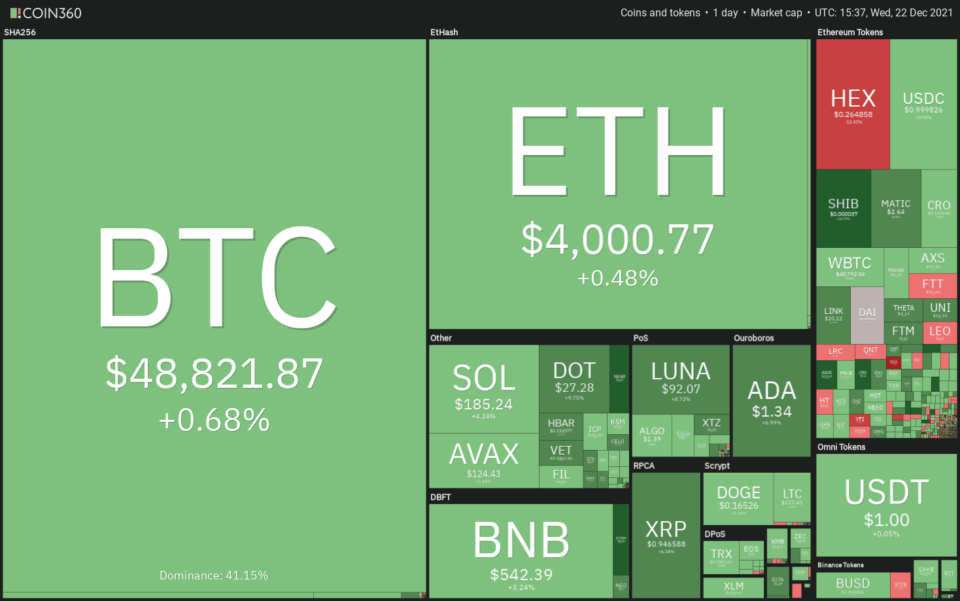

Daily performance of the cryptocurrency market. Source: Coin360

Another positive news that could further increase crypto adoption is a popular internet browser Opera has announced an integration with Polygon (MATIC), which is expected to go live in the first quarter of 2022. Millions of Opera users, first on the Android platform and then on other devices, will gain access to the Polygon ecosystem.

Could Bitcoin and the big altcoins extend their recovery in the last few days of the year? Let’s check out the top 10 cryptocurrency charts to find out.

BTC / USDT

Bitcoin fell below its 200-day simple moving average ($ 47,259) on December 17, but the bears failed to build on their advantage and continued to extend the decline. This shows that sales have dried up at lower levels.

BTC / USDT daily chart. Source: TradingView

BTC / USDT daily chart. Source: TradingView

The bulls pushed price back above the 200-day SMA on December 21st, but the rebound is facing resistance at the 20-day exponential moving average ($ 49,517). This suggests that the bears have not given up and are selling on rallies.

If the price drops down from current levels, the bears will try again to bring the price below the 200-day SMA and extend the decline into the strong support zone at $ 42,000 to $ 39,600.

Conversely, the BTC / USDT pair could rise to $ 52,000 if the bulls push the price above the 20-day EMA. This level can act as a barrier, but if the bulls push the price above it, the rally could hit the next big hurdle at $ 60,000.

ETH / USDT

The cops are trying to push and maintain ether (ETH) above the descending channel and the 20-day EMA ($ 4,055). If they are successful, it suggests that the correction phase may be over.

ETH / USDT daily chart. Source: TradingView

ETH / USDT daily chart. Source: TradingView

Buyers will then seek to push the price up to $ 4,488, near the all-time high of $ 4,868. A break and a close above this resistance indicate the resumption of the uptrend. The pair could then climb to $ 5,859.

Contrary to this assumption, this suggests that if the price deviates from current levels, sentiment will remain negative. The bears will then attempt to push the price below $ 3,643.73. If they do, the ETH / USDT pair could fall to the 200-day SMA ($ 3,302).

BNB / USDT

Binance coin (BNB) has held $ 500 psychological support for the past few days, suggesting buyers are aggressively defending the level.

BNB / USDT daily chart. Source: TradingView

BNB / USDT daily chart. Source: TradingView

The BNB / USDT pair could now move to the downtrend line where the bears could build strong resistance again. If the price deviates from this resistance, it suggests that sentiment remains negative and traders are selling on rallies.

A break and close below $ 500 could mark the next leg of the downward move that could hit the 200-day SMA ($ 437).

Alternatively, if the bulls are driving price above the downtrend line, it suggests that the correction may be over. The pair could then climb to $ 617 and later the overhead resistance at $ 669.30.

SOL / USDT

Solana (SOL) has been trading near the 20-day EMA ($ 183) for the past few days, suggesting that selling pressures may ease.

SOL / USDT daily chart. Source: TradingView

SOL / USDT daily chart. Source: TradingView

The flattening 20-day EMA and Relative Strength Index (RSI) just below the middle point to a bull comeback. A breakout and close above the 20-day EMA could trigger a stronger rebound to $ 204.10 and then to $ 240.

Conversely, this suggests that the bears have absorbed demand if the price declines from current levels to below $ 167. That could pave the way for a decline to $ 148.04. If that support breaks, the SOL / USDT pair could crash to the 200-day SMA ($ 121).

ADA / USDT

The Bears’ Failure to Draw Cardano (THERE IS) below $ 1.18 triggered a rebound that hit the 20-day EMA ($ 1.35).

ADA / USDT daily chart. Source: TradingView

ADA / USDT daily chart. Source: TradingView

If the price drops down from current levels, sellers will try again to bring the ADA / USDT pair below $ 1.18. If they are successful, the next stop could be $ 1. The bulls are likely to aggressively defend this support as it has not been breached in the past few months.

Conversely, if the bulls push and close above the 20-day EMA, it signals the beginning of a sustained recovery. The first hurdle is at $ 1.47, but if the bulls push the price above it, the pair could hit the stiff overhead resistance at $ 1.87.

XRP / USDT

XRP broke and closed above the 20-day EMA ($ 0.87) on December 20th, indicating that selling pressures are easing. The bulls are currently trying to push the price above the $ 1 psychological level.

XRP / USDT daily chart. Source: TradingView

XRP / USDT daily chart. Source: TradingView

The 20-day EMA has started to rise gradually and the RSI has jumped into positive territory, suggesting that the bulls have a slight advantage. A break and close above $ 1 could open the doors to a possible rally to $ 1.20 and near $ 1.41.

Conversely, the XRP / USDT pair could fall to the 20-day EMA if the price fell from $ 1. A strong rebound from this level suggests that sentiment has turned positive and traders are buying the dips. That increases the chance of a break above $ 1. However, if bears pull the price below $ 0.85, the pair faces a possible drop to $ 0.75.

MOON / USDT

Terra’s LUNA token broke and closed above the overhead resistance at $ 78.29 on December 20th, indicating the resumption of the uptrend.

LUNA / USDT daily chart. Source: TradingView

LUNA / USDT daily chart. Source: TradingView

The bullish momentum continued and the LUNA / USDT pair rose to $ 98.20 today. The sharp rally of the past few days has pushed the RSI into the overbought territory and the pair is nearing the psychological level at $ 100. This can lead to a slight correction or consolidation over the next few days.

If price drops down from current levels but rebounds from $ 78.29, it will suggest sentiment remains bullish and traders buy on dips. Buyers will then try to continue the uptrend with the next target at $ 124.65.

The bears must pull and hold below the 20-day EMA ($ 69.75) to signal a change in the short-term trend.

Related: Missed Hot Crypto Stocks in 2021? It was worth buying just Bitcoin and Ethereum, data shows

AVAX / USDT

Avalanche (AVAX) bounced off the 20-day EMA ($ 104) on December 20, suggesting that the bulls will buy on dips. The upside moved above the 61.8% Fibonacci retracement level at $ 119.69 on December 21, suggesting the bulls are back in the game.

AVAX / USDT daily chart. Source: TradingView

AVAX / USDT daily chart. Source: TradingView

There is a small resistance at the 78.60% Fibonacci retracement level at $ 131.70 which, if removed, could re-test the all-time high at $ 147. The bulls need to push and hold the price above this level to signal the start of the next leg of the uptrend.

The rising 20-day EMA and the RSI in positive territory suggest that the bulls have the upper hand. This positive view will be invalidated if the price goes down and falls below the 20-day EMA. Such a move could push the price down to $ 98. If that level drops, the next stop could be at $ 75.50.

DOT / USDT

Speckle (POINT) has ricocheted off the strong support zone at $ 25-22.66, suggesting that the bulls are vigorously defending this zone.

DOT / USDT daily chart. Source: TradingView

DOT / USDT daily chart. Source: TradingView

The rebound could reach the 20-day EMA ($ 28.21) first, where the bears are likely to build strong defense. If the price drops from this level, the bears will make another attempt to pull the price below the support zone.

If so, the DOT / USDT pair could fall to $ 16.81. Alternatively, if the price breaks above the 200-day SMA ($ 28.84), it suggests that the downtrend is weakening. The pair could climb to $ 31.49 first and then $ 39.35.

DOGE / USDT

Dogecoin (DOGE) bounced off strong support at $ 0.15 on Dec. 20, suggesting buyers are continuing to vigorously defend the level.

DOGE / USDT daily chart. Source: TradingView

DOGE / USDT daily chart. Source: TradingView

The DOGE / USDT pair has hit the 20-day EMA (USD 0.17) which is acting as strong resistance. If the price moves down from this level, the pair could be stuck between the 20-day EMA and $ 0.15 for a few days.

If this narrow-range trade dissolves on the downside, the pair could slide to $ 0.13 and a break below that level could lower the pair to $ 0.10 Euros).

Conversely, if the bulls push and hold the price above the 20-day EMA, the pair could rise to $ 0.19. This level could act as strong resistance again, but if crossed the pair could initiate a strong rebound to $ 0.22.

The views and opinions expressed are those of the author only and do not necessarily reflect the views of Cointelegraph. Every investment and trading movement involves risks. You should do your own research when making a decision.

Market data is provided by HitBTC Exchange.